Well,

Alanm, I can certainly agree, in totality, with your suggestion. Maybe not in the same way you might have meant it, but the words, themselves. If our federal government would remove the loopholes to the tax system, not even having to cut into the Big Three), that alone could save the government over $1.3 trillion ... no more mortgage exemptions, no more business deductions, no more investment exemptions, or corporate welfare, etc ... and

THEN, personal & corporate income taxes could possibly be adjusted downward. But, the tax code system has over 7,000+ pages, and, we all know those tax codes weren't written for the lower income in mind. And, we also know a lot of super wealthy and corporations pay little to nothing into taxes, thus requiring everyone, who doesn't have personal, $50,00 per year tax advisors & lawyers, to pay more. There are logical, fair solutions, but the vulture/crony capitalists won't allow it to happen. There's as much fairness in the tax system as there currently is in the legal system for blacks vs whites ... one side has unfair access to help that the other side doesn't.

Eventually, if we don't bring fairness to the system, however, we'll have exactly what we had at the beginning of the Great Depression, a major market & tax adjustment. It wouldn't surprise me that the very wealthy, the billionaires, know this will happen, and/or desire it to happen, have/are preparing for it, and plan to leverage their power to take the most advantage of it when it does happen.

Personally, I would suggest stimulating the economy from the middle (as it is proven to have worked), starting with major investments into our infra-structure. Then, determine what the minimum,

living wage necessary for poorest to make it, and build from there. THEN, Republicans & Democrats should sit down and discuss a BUDGET for the nation which would include both "fair" cuts to

all expenditures, and increases to revenue. At one time Obama offered a 4:1 entitlement cut to increase taxes, and Republicans (thanks to their leader, Marquist), flatly turned it down. Everyone has to come to the table to

give something up. There can be no negotiation when one side bleeds and the other side doesn't.

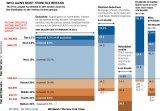

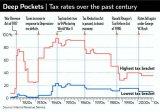

Here's a chart of the upper/lower tax rates over the past century. Who held the veto pen when these changes took place? Note, particularly, in 1980's when Reagan shifted more tax burden on the poorest, while cutting taxes for the richest, and starting our deficit spending spree that hasn't stopped since Reagan, Bush, & Cheney all agreed

"deficits don't matter".

View attachment 642710

But, it doesn't matter how many charts from the IRS or other true sources I put up, those against taxes (who enjoy the fruits of this country) will disagree as to why a certain level of revenue increase is not fair. And its funny, because records show that when taxes are raised on corporations, the corporations invest back into their businesses to avoid the extra taxes ... thus "creating jobs", totally contrary to the "cut taxes and jobs will be created" believers.